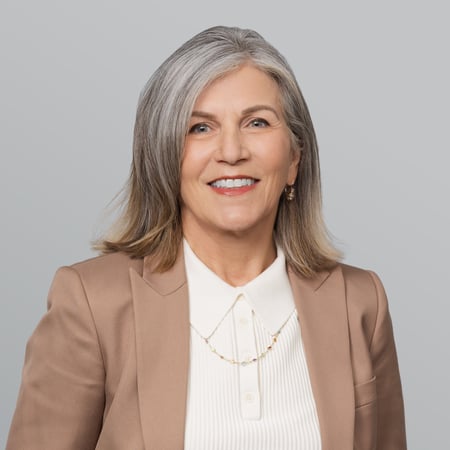

Rebecca DeCesaroRebecca DeCesaroManaging DirectorWealth Partner

Awards and Industry Recognition

Barron's

Forbes

About Rebecca

Rebecca DeCesaro is a Managing Director and Wealth Partner at J.P. Morgan Wealth Management.

Becky advises individuals, families and institutions, helping them make informed decisions about the direction and scope of their wealth and pursuing their goals more effectively. She has particular depth catering to the needs of multi-generational families, as well as endowments and foundations, offering the wisdom and perspective she has gained from supporting an accomplished clientele.

Clients seek Becky's advice for a host of needs, from taxsensitive portfolio design and wealth transfer to pre-sale planning for a business, investment policy statement development and family wealth dynamics. A capable collaborator, Becky works well with clients' external advisors, including their tax and legal intermediaries, as well as institutional board members and staff. To each relationship, she offers reliable responsiveness and a genuine desire to bring clients the ideas and insights that can have a meaningful impact on the trajectory of their wealth. Becky infuses significant care and energy into each relationship, proud to walk with clients through successive stages—building wealth, deploying wealth and transferring wealth to the people and causes they cherish.

Becky has more than three decades of experience in investing and wealth management. Prior to moving to J.P. Morgan Wealth Management with her team in 2023, she spent more than 17 years with First Republic Investment Management, where she was a Senior Managing Director and Wealth Manager. Becky's career also includes nearly six years with U.S. Trust, where she was a Senior Vice President and Portfolio Manager. Her portfolio management duties began in 1994, when she assumed the position of Chief Investment Officer for the Merchants Trust Company. She offers extensive institutional knowledge and has been employed by various investment banking and money management firms, including Montgomery Securities in San Francisco, Charles Schwab in Denver and Brown Brothers Harriman in Boston. She began her career in 1987 with Morgan Stanley in New York.

Originally from Montana, Becky earned her B.A. in Public Administration from Montana State University

Committed to giving back, Becky serves on the Board of Trustees of Oregon Public Broadcasting.

Becky and her husband, Michael, have two children and one grandchild, who make them very proud. Outside the office, she loves to hike, bike, garden, spend time outdoors, and be with her dogs, Yogi and Mia.

Insights

Software shock: AI’s broken logic

February 6, 2026Software rout sparks indiscriminate selling despite long-term artificial intelligence (AI) winners.Read Now

Fiscal fireworks: How debt is rewriting the rules for the US and Japan

January 30, 2026Rising government debt worries fuel weakness in traditional safe-havens but bolster gold’s powerful rally as investors search for the home of the next crisis.Read Now

Fed leaves rates unchanged to start 2026: Is a cut coming in March?

January 29, 2026The Federal Reserve held interest rates steady in January. Learn what investors can expect at the March meeting and how inflation and a shift in Fed leadership could affect rate decisions.Read Now

The new frontier: 3 themes driving alternatives in 2026

January 26, 2026Why we think alternatives are no longer optional.Read Now

3 cyber secure actions to add to your New Year’s resolutions

January 23, 2026New year, new emerging cybersecurity threats. These tips will help keep your digital presence under lock.Read Now

Debunking the “Sell America” trade: Why Europe’s move could fall short

January 23, 2026Despite policy uncertainty, the United States remains a high-conviction investment opportunity.Read Now

New 529 Plan Rules For 2026: Key Changes Under the One Big Beautiful Bill Act

January 21, 2026The One Big Beautiful Bill Act has expanded the way 529 plans can be utilized, transforming them from traditional college savings plans into more versatile financial planning tools that cover a wide range of educational expenses.Read Now

Family governance: A new way for adult siblings to connect

January 21, 2026Siblings may understandably grow apart over time. However, the quality of their relationships as adults can demonstrably impact the family’s ability to maintain its wealth.Read Now

Making the transition to retirement

January 21, 2026You have worked hard to plan for the retirement you want, and are now ready to enjoy the results. But before you make the transition from full-time work to retirement, there are a few things you should confirm.Read Now

Software shock: AI’s broken logic

February 6, 2026Software rout sparks indiscriminate selling despite long-term artificial intelligence (AI) winners.Read Now

Fiscal fireworks: How debt is rewriting the rules for the US and Japan

January 30, 2026Rising government debt worries fuel weakness in traditional safe-havens but bolster gold’s powerful rally as investors search for the home of the next crisis.Read Now

Fed leaves rates unchanged to start 2026: Is a cut coming in March?

January 29, 2026The Federal Reserve held interest rates steady in January. Learn what investors can expect at the March meeting and how inflation and a shift in Fed leadership could affect rate decisions.Read Now

The new frontier: 3 themes driving alternatives in 2026

January 26, 2026Why we think alternatives are no longer optional.Read Now

3 cyber secure actions to add to your New Year’s resolutions

January 23, 2026New year, new emerging cybersecurity threats. These tips will help keep your digital presence under lock.Read Now

Debunking the “Sell America” trade: Why Europe’s move could fall short

January 23, 2026Despite policy uncertainty, the United States remains a high-conviction investment opportunity.Read Now

New 529 Plan Rules For 2026: Key Changes Under the One Big Beautiful Bill Act

January 21, 2026The One Big Beautiful Bill Act has expanded the way 529 plans can be utilized, transforming them from traditional college savings plans into more versatile financial planning tools that cover a wide range of educational expenses.Read Now

Family governance: A new way for adult siblings to connect

January 21, 2026Siblings may understandably grow apart over time. However, the quality of their relationships as adults can demonstrably impact the family’s ability to maintain its wealth.Read Now

Making the transition to retirement

January 21, 2026You have worked hard to plan for the retirement you want, and are now ready to enjoy the results. But before you make the transition from full-time work to retirement, there are a few things you should confirm.Read Now